Contact us for a free local system survey

doug_robertson@asrsystems.com

Cell: 847-508-0538

Serving GA, FL, NC, SC & VA

Contact us for a free local system survey

doug_robertson@asrsystems.com

Cell: 847-508-0538

EQUIPMENT LEASING

Overview

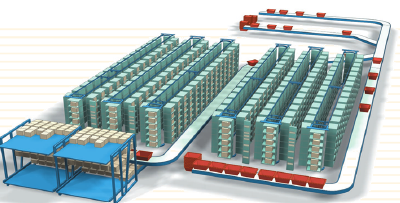

Leasing or renting are both similar options. Both convert a large up front capital cost into a monthly cost of usage. Comparing monthly cost of usage to monthly cost avoidance is a very powerful way of exposing how a client is already paying for the system he thinks he can't afford. The logic is actually quite simple. Typically a system generates a 1 - 2 year payback if purchased as a capital investment. Take that and spread it over 5 years and you will would expect a monthly cost advantage equal to a minimum of 5/2 or 2.5X in cost savings to monthly usage cost.

Benefits of Leasing Take the example of a carousel system that costs $550,000 and saves $35,000 a month in space and labor. Lots of up front costs you may think. Convert that to a monthly lease using a multiplier of roughly 0.02 x $550,000 and you have a monthly cost of usage = $11,000 (i.e. lease cost) for a monthly positive cash flow saving of $24,000. The numbers are almost always in the same proportions every time they are run. The lease factor will be raised or lowered according to current interest rates, credit worthiness, length of term and residual. The 0.02 factor is a pretty close estimate for 5 year lease with a FMV buy out (also called residual) for a credit worthy firm. For a less credit worthy firm it might be 0.022. The less credit worthy firm would see a 3 year lease factor of about 0.0323 or $17,750 using the FMV residual. This generates about a 2 to 1 savings to cost. For a dollar buyout option the 3 year factor would be 0.034 or $18,150 per month, still almost a 2:1 positive cash flow saving.

Summary

To summarize, in all cases the client puts big money in his pocket each month while also paying for the system or most of the system over an extended period of time. The difference with renting is they do not actually pay down the system as the option for ownership transfer is not there (renting may be better than leasing in that sense). Rental is generally about twice as much as a five year lease rate with 20% residual. In the example that would be about $18,000 a month, still generating a huge pocket full of extra profit each month.